mass tax connect make estimated payment

Generally you must make estimated tax payments for the current tax year if both of the following apply. Read on for a step by step guide on making tax payments in MA.

Make your estimated tax payments online at massgovmasstax-connect and get immediate confirmation.

. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile. How To Pay Estimated Taxes. How do I pay estimated taxes on mass tax connect.

From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1. Make your estimated tax payment online.

The Massachusetts income tax rate. The reason why it is an estimated tax payment is because you do not know exactly what your tax. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

Your support ID is. Use this link to log into Mass Depa. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Its fast easy and secure. Please enable JavaScript to view the page content. Please enable JavaScript to view the page content.

Select Payment Type choose Return Payment for year 2019 if paying the balance. Your support ID is. For some workers tax season doesnt end on April 19.

Mail to Massachusetts Department of Revenue PO Box 419272 Boston MA 02241-9272. Select the Individual payment type radio button. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. The first step in making estimated tax payments is to calculate what you owe.

How To Make Ma Dor Income Tax Payments Online The Onaway

Massachusetts Dept Of Revenue Massrevenue Twitter

A Complete Guide To Massachusetts Payroll Taxes

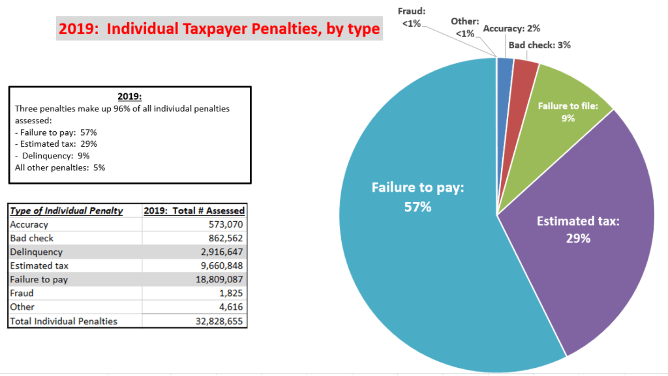

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

1040 2021 Internal Revenue Service

Capital Gains Tax Ma Can You Avoid It Selling A Home

How Owners Of Short Term Rentals Can Register Their Property Cciaor

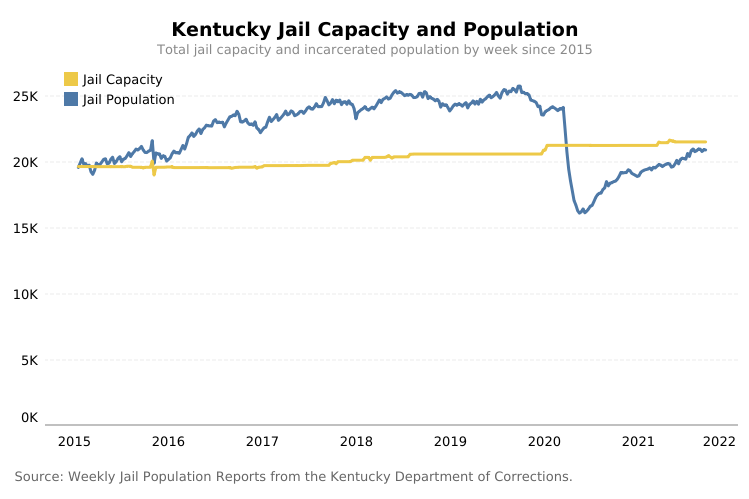

The Golden Key How State Local Financial Incentives To Lock Up Kentuckians Are Perpetuating Mass Incarceration Kentucky Center For Economic Policy

How To Make Ma Dor Income Tax Payments Online The Onaway

Everything You Need To Know About The Massachusetts State Refund 2022 Forbes Advisor

Millions Of Mass Taxpayers Will Get Money Back Starting In November Officials Say Here Are The Details The Boston Globe

Corporate Minimum Tax Examples Apple Would Likely Pay More 3m Would Not Itep

How To Start An Llc In Massachusetts For 49 Ma Llc Formation Zenbusiness Inc

Massachusetts Rhode Island Natp Chapter Making 2018 Estimated Payments For Individual Taxpayers On Masstaxconnect

Capital Gains Tax Calculator Estimate What You Ll Owe

Massachusetts Flavored Tobacco Ban Has Severe Impact On Tax Revenue

Massachusetts Sales Use Tax Guide Avalara

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back